PF Joint Declaration Form PDF Download 2024: Today, through this article, we will talk to you about PF Joint Declaration Form PDF Download 2024. Whether you are from any state of India like UP/Maharashtra/bihar/cg/mp/odisha/gujarat/haryana/punjab etc., then you can easily download PF Joint Declaration Form PDF 2024 here. We have given the link to download the form in our article below, which you can check by going to the article below.

Employee Provident Fund (EPF) is a vital part of every salaried employee’s financial planning in India. It ensures a secure post-retirement life by systematically saving a portion of the employee’s salary. However, sometimes discrepancies can arise in the details submitted to the EPF office.

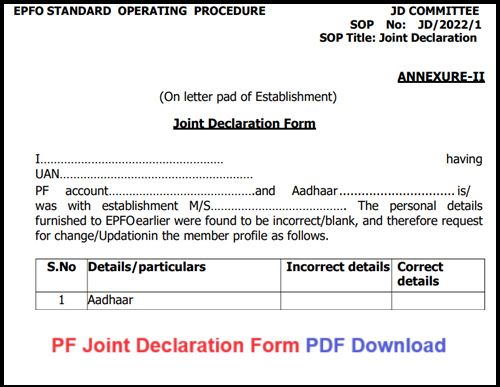

This is where the PF Joint Declaration Form comes into play. This form is essential for rectifying any mistakes in an employee’s EPF details. In this blog post, we’ll dive into what the PF Joint Declaration Form is, its importance, and the steps to fill it out.

Short Details

| Article Name | PF Joint Declaration Form PDF Download |

| State | All States of India |

| Pdf Form | Available Now |

| Official Website | https://www.epfindia.gov.in/site_en/index.php |

What is the PF Joint Declaration Form?

The PF Joint Declaration Form is a document jointly submitted by the employee and the employer to the EPFO (Employees’ Provident Fund Organisation). This form is used to correct errors in the EPF details such as:

- Name of the employee

- Date of birth

- Date of joining or leaving the company

- Father’s or spouse’s name

- Any other personal information that might have been incorrectly recorded

Aadhar Card Address Change Form Pdf Download 2024

Why is it Important?

Ensuring accurate details in your EPF account is crucial for several reasons:

- Smooth Withdrawal Process: Correct information ensures that the withdrawal process is smooth and without any hitches.

- Avoidance of Legal Issues: Accurate details help in avoiding legal complications that can arise due to mismatched information.

- Seamless Transfers: When switching jobs, transferring your EPF account is easier if all details are correct.

- Timely Pension: Correct details ensure timely pension disbursement without unnecessary delays.

How to Fill the PF Joint Declaration Form?

Filling out the PF Joint Declaration Form requires careful attention to detail. Here’s a step-by-step guide:

- Download the Form: Obtain the PF Joint Declaration Form from the EPFO website or from your employer.

- Fill in the Basic Details:

- Employee Name: Enter the correct name as per official records.

- Employee PF Account Number: Provide your unique PF account number.

- Name of Establishment: Enter the name of your company or establishment.

- UAN: Universal Account Number (UAN) provided by EPFO.

- Specify the Corrections:

- Clearly mention the details that need to be corrected. For example, if it’s a name correction, write the incorrect name and the correct name.

- Attach supporting documents like a copy of Aadhaar, PAN card, or any other valid ID proof to validate the correction.

- Employer’s Attestation:

- The employer must attest to the corrections by signing and stamping the form. This indicates that the employer verifies and agrees with the proposed changes.

- Submit the Form:

- Submit the duly filled and attested form to the regional EPF office. It’s advisable to keep a copy of the form for your records.

Download PF Joint Declaration Form PDF Download 2024

Common Issues and How to Avoid Them

- Incomplete Information: Ensure that all fields are correctly filled and no section is left blank.

- Incorrect Documents: Attach the correct supporting documents. Inaccurate or mismatched documents can lead to rejection.

- Employer’s Attestation Missing: Without the employer’s signature and stamp, the form will not be accepted.

Conclusion

The PF Joint Declaration Form is a crucial document for rectifying any discrepancies in your EPF account details. Ensuring accurate and updated information in your EPF account helps in a hassle-free withdrawal process and avoids potential legal issues. Always double-check the information and consult with your employer if you need assistance. With the right steps and proper documentation, correcting your EPF details can be a straightforward process.