Today, through this article, we will talk to you about “PAN Card Correction Form 49a Pdf Download & PAN Change Request or Correction Form”. Here we will tell you how you can download the PDF of these forms. For this, read this article till the end because we have also given the link to download the PDF in this article, with the help of which you can download these forms.

What is a PAN Card?

A Permanent Account Number (PAN) card is a vital document issued by the Income Tax Department of India. It is a ten-digit alphanumeric identifier unique to each individual, company, or entity involved in financial transactions in India. The PAN card is primarily used for tax purposes, ensuring that every financial transaction can be traced and accounted for.

What is a PAN Correction Form?

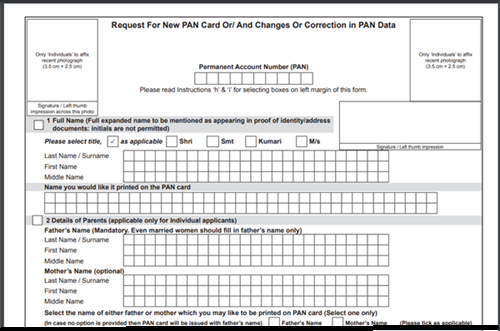

A PAN correction form, also known as Form 49A, is used to request changes or corrections to the details provided on your PAN card. If you notice any discrepancies or need to update information such as your name, date of birth, address, or photograph, this form allows you to apply for the necessary corrections. Ensuring that your PAN card details are accurate is crucial for seamless financial operations.

Hamipatra Ladli Behna Yojana Form Pdf Download Maharashtra

PAN Card Benefits

- A PAN card is required for various financial transactions such as opening a bank account, applying for loans, purchasing property, or investing in securities.

- It simplifies the process of filing income tax returns and helps track taxable monetary activities, ensuring transparency and compliance.

- PAN card serves as a valid proof of identity and age across India.

- Having a PAN card helps in avoiding higher tax deductions at source (TDS) on interest earned on bank deposits.

- It is required for conducting foreign currency transactions and for making remittances abroad.

For Whom is a PAN Card Necessary?

A PAN card is necessary for:

- Any individual earning taxable income in India, including salary, business income, or capital gains.

- Companies, firms, and other entities engaging in financial transactions need a PAN for tax purposes.

- Non-Resident Indians involved in financial transactions or investments in India.

- Minors earning taxable income or requiring the card for investments.

- Foreign nationals engaging in business or financial activities in India.

How to Download PAN Card Correction Form 49A PDF?

To download the PAN Card Correction Form 49A PDF, follow these steps:

- First of all you have to visit the official website. Here two official websites for PAN services are NSDL (https://www.tin-nsdl.com) and UTIITSL (https://www.utiitsl.com).

- Look for the PAN card services section on the homepage.

- Choose the option for PAN card correction or changes.

- Find and download the Form 49A PDF for corrections or changes.

Download: Request For New PAN Card Or/ And Changes Or Correction in PAN Data Pdf Form

How to Download PAN Change Request Form?

The process to download the PAN Change Request Form is similar to downloading Form 49A. Here are the steps:

- Go to NSDL (https://www.tin-nsdl.com) or UTIITSL (https://www.utiitsl.com).

- Look for the relevant section dealing with PAN card services.

- Select the option for making changes or requesting corrections in your PAN card.

- Download the PAN Change Request Form available in PDF format.

Download: PAN Card 49a Pdf Download

FAQ’s

1. What details can be corrected using the PAN Card Correction Form 49A?

You can correct or update several details using Form 49A, including your Name, Date of birth, Father’s name, Address, Signature, Photograph & Contact details

2. Where can I download the PAN Card Correction Form 49A PDF?

You can download the PAN Card Correction Form 49A PDF from the official websites of NSDL and UTIITSL which is (https://www.tin-nsdl.com) or UTIITSL (https://www.utiitsl.com) website.

3. What documents are required to submit along with the PAN Change Request Form?

When submitting the PAN Change Request Form, you need to provide supporting documents for the changes requested. Commonly required documents include:

Proof of identity (Aadhaar card, voter ID, passport, etc.)

Proof of address (utility bills, bank statement, Aadhaar card, etc.)

Proof of date of birth (birth certificate, Aadhar Card, school leaving certificate, etc.)

4. Is there a fee for submitting the PAN Card Correction Form?

Yes, there is a fee for submitting the PAN Card Correction Form. As of now, the charges are:

For online communication address within India: INR 110 (including GST)

For online communication address outside India: INR 1,020 (including GST)

Correction/ Re-issuance of PAN Card: INR 50 (With GST) for Indian citizens, INR 959 (With GST) for foreign citizens